tax sheltered annuity definition

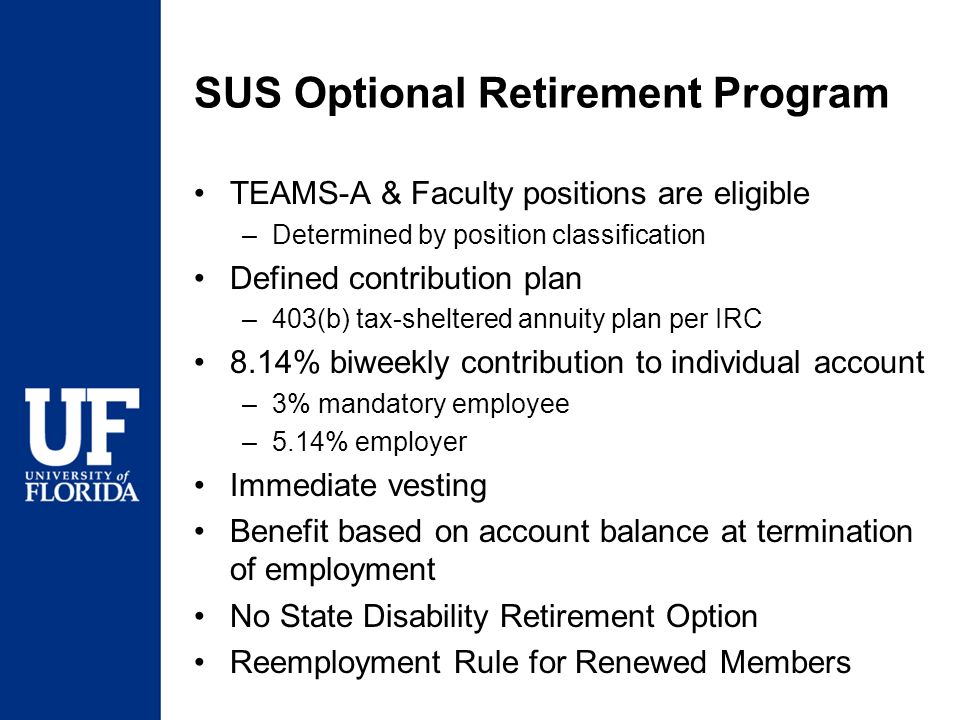

In addition to those payroll deductions required by law including state income tax employees may request deductions be taken from. A 403 b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain.

Tax Sheltered Annuity Faqs Employee Benefits

Employees save for retirement.

. A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. Everything you need to know about Tax-Sheltered Annuity. Tax-Sheltered Annuity Definition Meaning Example Annuities Business Terms Retirement Planning.

Tax Sheltered Annuities synonyms Tax Sheltered Annuities pronunciation Tax Sheltered Annuities translation English dictionary definition of Tax Sheltered Annuities. A tax-sheltered annuity TSA is a retirement plan for non-profit organizations such as schools hospitals charities and churches. Tax-sheltered annuity synonyms Tax-sheltered annuity pronunciation Tax-sheltered annuity translation English dictionary definition of Tax-sheltered annuity.

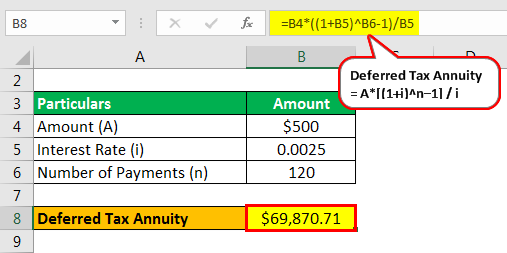

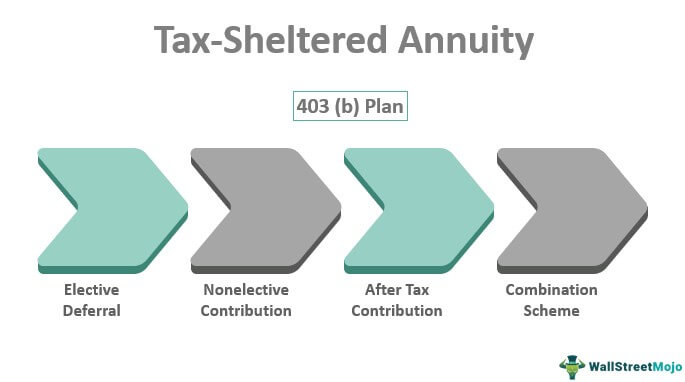

Examples of Tax Sheltered Annuities in a sentence. Tax-sheltered annuity synonyms Tax-sheltered annuity pronunciation Tax-sheltered annuity translation English dictionary definition of Tax-sheltered. A tax-sheltered annuity TSA also referred to as a tax-deferred annuity TDA plan or a 403 b retirement plan is a retirement savings plan for employees of certain public.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. An annuity that enables. Tax Sheltered Annuity means an annuity purchasedby a public school employerfor an employeepursuant toprovisions of theInternal Revenue Code the premiumsfor which are not.

An annuity that enables. These organizations can set up a TSA. Define Tax Sheltered Annuity.

Tax Sheltered Annuity synonyms Tax Sheltered Annuity pronunciation Tax Sheltered Annuity translation English dictionary definition of Tax Sheltered. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way.

The most common tax-sheltered investments. It is also known as a 403 b retirement plan and. Examples of Tax Sheltered Annuity Plans in a sentence.

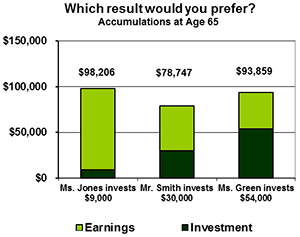

Tax-sheltered annuity TSA A retirement plan that permits an employee of a tax-exempt charitable educational or religious institution to contribute a certain portion of wages or salary. A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income. TAX SHELTERED ANNUITIES The SPS shall continue to comply with the laws regarding Tax Sheltered Annuities.

Tax Sheltered Annuity synonyms Tax Sheltered Annuity pronunciation Tax Sheltered Annuity translation English dictionary definition of Tax Sheltered Annuity.

/retirement_plans-5bfc3081c9e77c0026b5e754.jpg)

The Pros And Cons Of Annuities

Tax Deferred Annuity Definition Formula Examples With Calculations

Introduction To Annuities Ppt Download

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

Annuity Taxation How Various Annuities Are Taxed

Withdrawing Money From An Annuity How To Avoid Penalties

What Is An Annuity Learn How Annuities Work From An Expert 2022

How To Buy An Annuity Morningstar

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)

What Is An Annuity Definition Types And Tax Treatment

Everything You Need To Know About Annuity Investing In 2022 Thinkadvisor

Retirement Overview By Eric Kegley State Retirement Plans Sus Optional Retirement Program Orp Only Faculty And Senior Staff Eligible Florida Retirement Ppt Download

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

What Is The Best Thing To Do With An Inherited Annuity Due

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Your Client Wants To Leave Her Defined Benefit Pension How Can She Turn It Into Cash Advisor S Edge

Who Uses A 403 B Plan Part One By Admin Partners Llc Medium

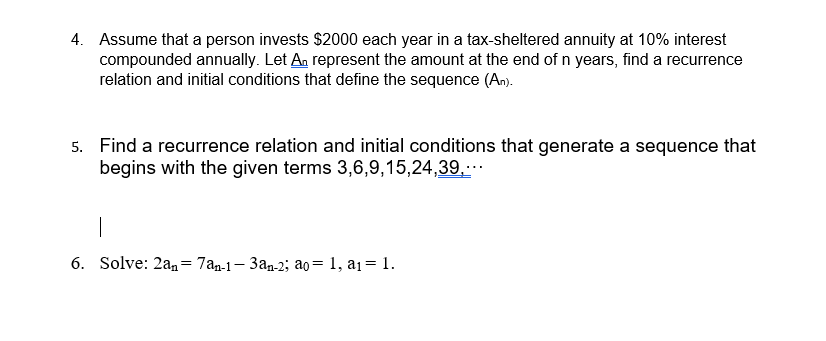

Solved 4 Assume That A Person Invests 2000 Each Year In A Chegg Com

:max_bytes(150000):strip_icc()/Safe-Retirement-Withdrawal-Rate-57a521625f9b58974aa2b94a.jpg)